According to the latest data released by WSTS, compared with the second quarter of 2022, the semiconductor market in the third quarter of 2022 fell 6.3% month on month. Based on the outlook for the fourth quarter of 2022, the semiconductor market in the second half of 2022 will decline by more than 10% compared with the first half of 2022. This will also be the largest drop since the first half of 2009, when the year-on-year decline was 21%.

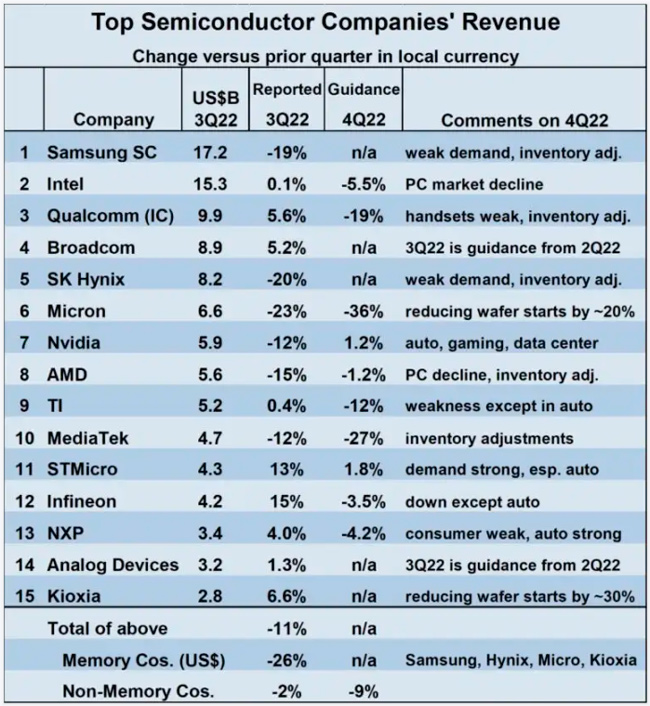

Specifically, compared with the second quarter of 2022, the revenue changes of top semiconductor companies in the third quarter of 2022 were mixed. 9 of the 15 companies reported (or guided) the revenue growth in the third quarter of 2022, of which Infineon had the highest growth rate of 15%; The growth rate of STF Semiconductor was 13%, followed by that of STF Semiconductor. The other six companies reported a decline in revenue, of which Samsung, SK Hynix and Micron Technologies saw the largest declines in revenue, with declines of - 19%, - 20% and - 23%, respectively.

From the perspective of ranking, although the storage market has declined, Samsung still successfully maintained its first position, ahead of Intel, which ranked second. Qualcomm rose to third place, Broadcom ranked fourth, and SK Hynix ranked fifth.

The revenue outlook of the top ten semiconductor manufacturers in the fourth quarter of 2022 is generally gloomy, especially for storage manufacturers.

According to the guidance of Micron, its revenue in the fourth quarter of 2022 will be 36% lower than that in the third quarter of 2022. In addition, Micron announced that it would reduce its wafer production by about 20%. Kioxia also announced in October that it would reduce its wafer production by about 30%. Although Samsung and SK Hynix did not give specific revenue guidance, they both listed weak demand and inventory adjustment as factors affecting the fourth quarter's revenue.

Among non memory chip manufacturers, Qualcomm, Texas Instruments and MediaTek all expect a double-digit 100% decline in revenue in the fourth quarter of 2022. Most enterprises attribute weak overall demand and customer inventory adjustment to the bleak market demand outlook. It seems that only the automobile market is the only healthy part.

Texas Instruments, STC, Infineon and NXP all said that the growth of the automobile industry largely or partially offset the decline of other industries.

Of the ten companies providing guidance for the fourth quarter of 2022, only NVIDIA (+1.2%) and STF Semiconductor (+1.8%) are expected to increase revenue.

The weighted average revenue change of the nine non memory chip companies providing guidance is 9% lower in the fourth quarter of 2022 than in the third quarter of 2022.

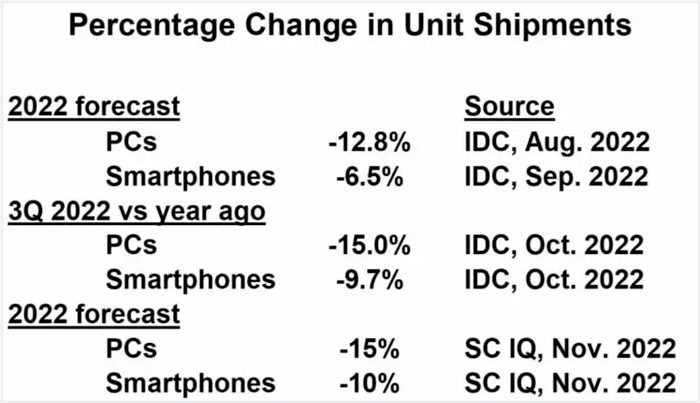

From IDC's forecast of global PC and smartphone shipments in the third quarter of 2022, it can be clearly seen that the major terminal markets such as PC and smartphone are weak. For example, in the third quarter, PC shipments fell by 15% year on year, while smartphones fell by 9.7% year on year. IDC expects that in 2022, global PC shipments will decline by 12.8% and smartphone shipments will decline by 6.5%. In addition, Semiconductor Intelligence predicts that PC shipments will decline by 15% and smartphone shipments will decline by 10% in 2022.

Forecast of global PC and smartphone shipments:

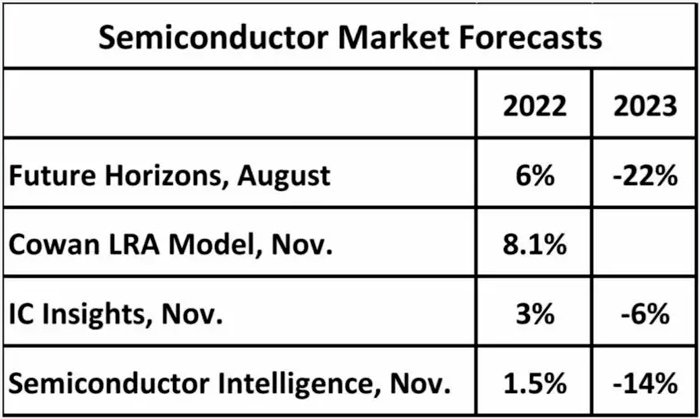

In view of the 6.3% decline in the semiconductor market in the third quarter of 2022 and the bleak outlook for the fourth quarter of 2022, only the forecasts made after the WSTS data release in the third quarter of 2022 are relevant.

The forecast of semiconductor market in 2022 given by Cowan LRA model in November 2022 is 8.1% year-on-year growth; IC Insights forecasts a year-on-year growth of 3%; However, Semiwiki's Semiconductor Intelligence forecast is pessimistic, with a year-on-year growth of only 1.5%. Based on this, the semiconductor market will definitely decline in 2023.

IC Insights predicts that the global semiconductor market will decline by 6% year on year in 2023, while Semiwiki Semiconductor Intelligence predicts that it will decline by 14% year on year. Interestingly, as early as August this year, Future Horizons predicted that in 2023, it would decline by 22% year on year.

Semiconductor market forecast in 2022 and 2023

The WSTS committee met last week to discuss its autumn forecast, which will be released in the next two weeks. It is interesting to see how much it has changed from WSTS's forecast of 13.9% growth in 2022 and 4.6% growth in 2023 updated in August.

Semiwiki Semiconductor Intelligence predicts that the semiconductor market will decline by 14% year-on-year in 2023, which will be the largest drop since the semiconductor market fell by 32% year-on-year in 2001. In the past 50 years, the market has experienced double-digit year-on-year decline in only three years: 1975, 1985 and 2001.

However, Semiwiki's prediction of a year-on-year decline of 14% in the semiconductor market in 2023 is based on the following assumptions: inventory correction will be resolved in the next two to three quarters; PC and smart phones will return to the pre pandemic trend by the middle of 2023; There will be no global recession in 2022 or 2023. Semiwiki said that if any of the above assumptions are not realized, the semiconductor downturn may last until the whole quarter of 2023, leading to a year-on-year decline of more than 20% in the semiconductor market in 2023.